Checking your month-to-month credit card announcement can sometimes sense like studying cryptic code. A number of the diverse abbreviations and jargon, you could have stumble upon the baffling entry “COMN CAP APY F1 AUTOPAY” and questioned, “What does that even mean?” don’t worry, you are not alone. In this complete guide, we’re going to demystify this difficult time period and assist you apprehend its significance for your card assertion.

What is COMN CAP APY F1 AUTOPAY?

Let’s break down this abbreviation piece by piece:

- COMN = Common

- CAP = Capitalized

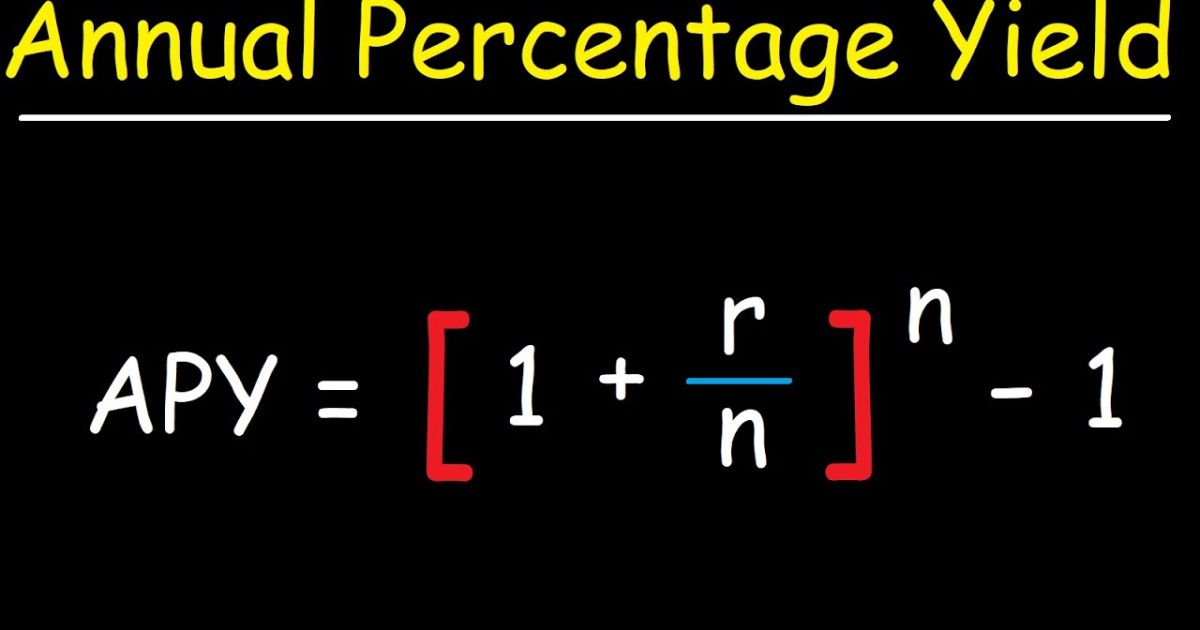

- APY = Annual Percentage Yield

- F1 = Finance Charge 1

- AUTOPAY = Automatic Payment

Now that we have decoded the character additives, permit’s put them back collectively and give an explanation for what this entry indicates in your credit score card assertion.

COMN CAP APY F1 AUTOPAY usually suggests that an automated price changed into made, in all likelihood for an annual rate charged by your card provider.Many famous credit playing playing cards, specially the ones supplying rewards or travel perks, include annual charges starting from $ninety five to $550 or more.

Here are some examples of well-known credit cards with annual fees:

- Chase Sapphire Reserve: $550

- American specific Platinum Card: $695 (See rates & expenses)

- Citi status Card: $495

- Marriott Bonvoy superb™ American explicit® Card: $650 (See prices & charges)

While those charges can also seem steep. They regularly include treasured advantages and perks which can offset the fee for frequent travelers or individuals who maximize the rewards. A few common advantages consist of:

- Airline fee credits

- Complimentary airport lounge access

- Hotel elite status

- Statement credits for travel purchases

- Higher earning rates on specific categories

Recommended post : Unlock Your Dream: A Step-by-Step Guide to Financing a Home in Costa Rica

The Annual Percentage Yield (APY)

You will be questioning, “Why does my credit score card announcement display an APY (Annual percent Yield) amount?”. The APY refers back to the hobby earned on an account over 12 months. Which may additionally appear inappropriate for a credit score card. But, whilst you pay an annual price, the card provider is technically keeping your cash for a period before the charge is processed. At some stage in this time, they’re required to pay you a small amount of hobby on the charge quantity, that is pondered because the APY.

For example, in case your annual rate is $95, and the APY shown is zero.01%, you might see a minuscule amount like $zero.01 listed as the APY. While this interest fee is negligible, it’s a regulatory requirement for the card company to reveal it.

Avoiding Confusion

To avoid any confusion, it is usually a great idea to study the transaction info to your credit score card declaration. The precise fee that brought about the “COMN CAP APY F1 AUTOPAY” entry must be listed one after the other, frequently with an extra descriptive label like “ANNL charge” or “ANNUAL membership rate.”

If you’re nevertheless uncertain about a selected charge, do not hesitate to touch your card provider’s customer support for clarification.

Recommended also this: Your 2024 Guide to Real Estate Financing in Costa Rica

Autopay Benefits and Downsides

While the “AUTOPAY” portion of the abbreviation may appear self-explanatory, it’s well worth exploring the professionals and cons of putting in place automated bills on your credit score card payments.

Benefits of Autopay:

- convenience: by no means miss a fee due date, as the amount is mechanically deducted from your particular account.

- keep away from late fees: via making sure well timed bills, you can steer clear of steeply-priced overdue expenses charged via card issuers.

- capability interest savings: if you normally convey a stability, automating your payments permit you to avoid accruing extra interest charges due to ignored or past due bills.

Potential Downsides of Autopay:

- Overspending threat: If you’re not carefully budgeting and monitoring your spending, autopay can lead to overdrafts or insufficient finances for your certain account.

- not on time refund processing: Within the occasion of money back or credit in your account. The autopay device can also nonetheless attempt to gather the whole assertion stability, causing ability headaches.

As with any economic decision, it’s vital to weigh the pros and cons based on your non-public instances and spending conduct.

Conclusion

While “COMN CAP APY F1 AUTOPAY” can also seem like gibberish at the start look. It is certainly an abbreviation indicating that your card company has routinely deducted an annual price from your account. This paid you a minuscule amount of interest on that rate, as required through rules.

To avoid any confusion or surprises on your credit card statement, it’s always a good practice to:

- Review your announcement very well, paying close interest to transaction info and descriptions.

- Contact your card company’s customer support if you have any questions or discrepancies.

- Cautiously bear in mind the professionals and cons of putting in autopay in your credit score card payments.

Through understanding the meaning behind abbreviations like “COMN CAP APY F1 AUTOPAY,” you could better navigate the sector of credit score card statements and make knowledgeable selections approximately your price range.

Don’t forget, information is power, and being an informed customer is the key to coping with your credit score playing cards correctly.